Since this is my first post relating to investments, I would like to explain why you should make investments and what you should consider before making any investments decisions.

Here, “investments” include not only stock investments, but also investments to time deposits, mutual funds, ETFs (exchange-traded Fund) and other type of financial products.

1. Why You Should Make Investments

1.1 Possibility for doubling the funds through Compound Interests

In Japan, people tends to have negative images towards stock investments because after making stock investments you might end up losing money, and in this sense, some people consider stock investments as an equivalent to gambling. On the other hand, it is often discussed how important to save up enough money, say $300,000 (or some might say you need at least $1,000,000), before retirement.

Most of articles which discuss about retirement funds focus on the amount of money you might need (i.e., why you need that amount of money) upon retirement. But those articles rarely mention how to reach to that amount before the retirement. So, assuming an article urge you to save $1,000,000 before retirement, it will give you an impression that you need to come up with $1,000,000 from your salary. However, if you are able to keep investing at high interest rates, you might be able to secure enough retirement fund even if the amount of money you can earn from your work or amount of money you can spare for the saving/investing is far less than the amount you want to accumulate by the time you retire.

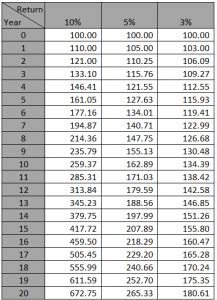

For example, assume you invested $100 and it grew 10% every year which you kept reinvesting without withdrawing each year, your initial $100 will become $110 at the end of the first year ($100 multiplied by 1.1), $121 at the end of second year ($$110 multiplied by 1.1). As summarized in the below table, if your money keep compounding at the rate of 10%, it will become $259 at the end of 10th year, and $673 at the end of 20th year. For your information, the below table also contains results when the interests are compounded at 5% or 3%. As you can see, after 20 years, your initial $100 will become $265 if the annual interests was 5%, or becomes $181 if the annual interests rates was 3%.

By the way, by using “Rule of 72”, you can easily calculate the relationship between number of years and rate of interests which you need to double your money (compound investments is assumed). According to this rule, “72 divided by rate of interest equal to number of years needed to double the money”. As illustrated below, the results of the above table confirms that this rule is accurate.

- compound interest at a rate of 10%(2.14 times in 8 years):72 ÷10= 7.2 years

- compound interest at a rate of 5%(2.08 times in 15 years ):72 ÷ 5= 14.4 years

- compound interest at a rate of 3%(2.03 times in 24 years):72 ÷ 3= 24.0 years

You might think it is impossible to constantly obtain 10% yield, since stock price of US companies is very volatile (for example, stock price of Facebook was $29.6 in May 2012 at the time of IPO, declined at $18.6, then reached $181 in November 2017, which is over 1000% increase in 5 years). Therefore, if you use stock investments in your portfolio, obtaining 10% yield is not impossible to achieve.

1.2 Ability to collect profits while leaving the principle intact

It might hurt your long term yield, but it is possible to earn income without withdrawing principle by receiving interests and dividends instead of reinvesting them.

Probably it is more efficient if you reinvests all the interests and dividends while you have employment incomes, and once you retire, you can start spending interests and dividends to pay living expenses. If you want to take this approach, following considerations might help deciding to which financial products or stocks you can invest.

- In case of stock investments, since most the companies pay dividends quarterly, you could collect dividends every month if you split the investments to stock of companies who pay dividends in January, April, July, October; companies who pay dividend in February, May, August and November; companies who pays dividend in March, May, September and December.

- Invest to funds which pay monthly dividends such as REIT.

2. What You Should Consider Before Making Any Investments

2.1 Determine What is the Purpose of Saving Money

If you are one of the person who think “it is risky to investing in stocks” or “I might end up losing money if I invest in stocks”. you might be confused with “investment” and “trading” or “speculation”.

In short, investments is done to maximize profits in a long term, while trading or speculations are done to earn quick money in a short period of time.

In this site, I am focusing on investment. Especially, in case of stock investments I would probably think in the span of 5 or 10 years (could be even longer). As a general rule, if you plan to use the money relatively in a short period of time, such as the purpose of the investment is to earn extra money before going to a trip next year, or planning to use for schools in in 2 -3 years or for down payment in buying a house, it is safe to invest to products which has lower risks such as CD, mutual funds and ETF, rather than stocks.

2.2 Understand Your Risk Appetite

This topic will be discussed in other occasion, but you need to consider if you want to pursue “High Risk High Return”, or “Low Risk Low Return”, or go somewhere in between.

2.3 Diversification

Needless to say, even if you find very promising investments, please bear in your mind that it is very risky to put all the available money into one basket.

In my investments, I have been diversifying very widely which includes funds, ETF, stocks (trying to diversify in various industries), ETF which track S&P 500(actually, I have been diversifying way too much and probably not a good example.

I plan to discuss what is the best way to diversify in my future post.

**********************

I am a Japanese, residing in the US. I am trying to find a way to earn stable income at home through investments in stocks or other products as well as some sort of internet business. ▶ More detailed profile can be viewed from here.

Latest posts by 暮眞★潤 (Jun Kurema) (see all)

- Basics about IRA (Individual Retirement Account) and 401(k) (Tax-Qualified, Defined-Contribution Pension Account ) for 2024 - 2024-01-08

- Learn from Jim Cramer: Basics of Stock Investments (1)~Who is Jim Cramer? - 2020-09-26

- Learn from Jim Cramer: Revised COVID-19 Index and Stocks to Consider Buying Now (June 2020 Ver.) - 2020-06-30

- Learn from Jim Cramer: List of Stocks Which Can Beat Coronavirus Pandemic(May 2020 Version)~ Revised COVID-19 Index - 2020-05-27

- Enjoy Free Streaming of Metropolitan Opera’s performance (During Stay-At-Home periods: Mar.16, 2020 – July 25, 2021):Nightly Met Opera Streams - 2020-05-16